My Medical Benefits

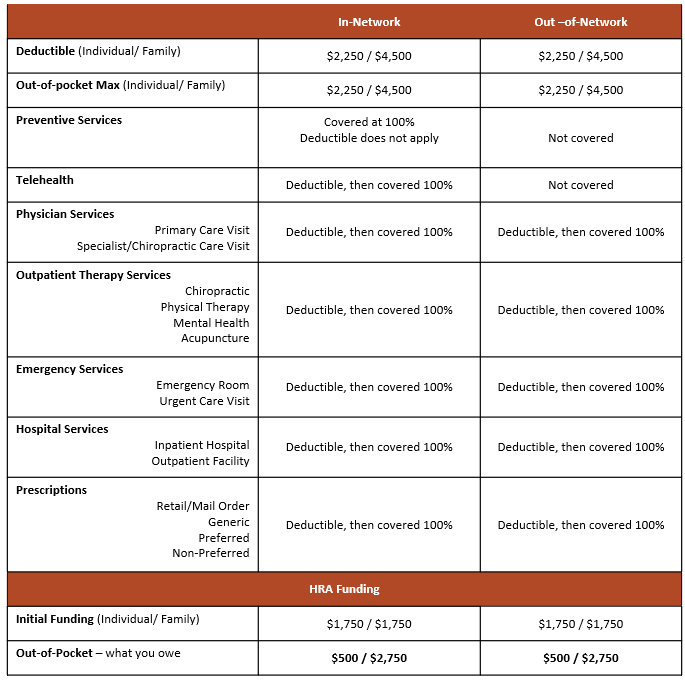

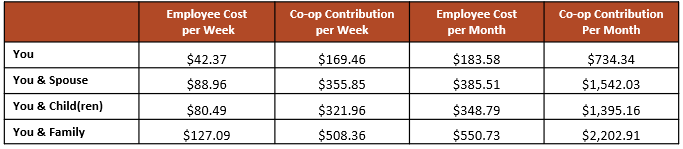

City Market offers medical coverage through Cigna’s Open Access Plan (OAP) with a Health Reimbursement Account (HRA).

Contributions

Eligibility

All full-time employees who work at least twenty (20) hours per week are eligible for medical coverage the first of the month following/coinciding with 90 days of continuous employment. Eligible dependents include spouse and dependent children to age 26.

Pharmacy Information

MyCigna.Com Resources

Forms and Plan Information

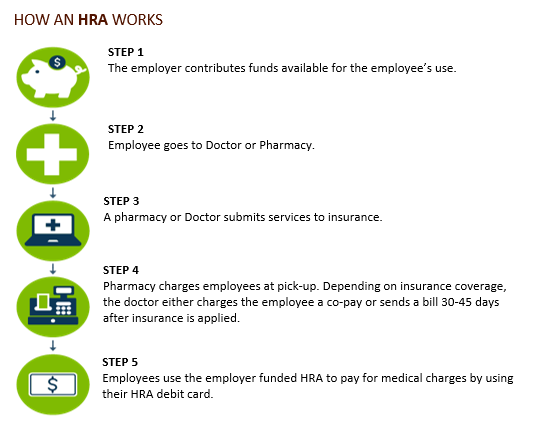

My Reimbursement Account Benefits

City Market employees who enroll in medical coverage receive funding to assist with reaching their annual medical deductibles. Employees receive $1,750 for Individual or couple/family coverage. Employees must enroll in a medical plan offered by City Market to be eligible to enroll in an HRA. HRA funding does not apply to dental or vision expenses.

- Once enrolled in the medial plan, an HRA Cigna Debit Card will be mailed to your home address on file in Paylocity. These debit cards are active for 3-year periods and can be used in multiple plan years. If you have an expired HRA Cigna Debit card or need a replacement card, you must contact Cigna directly with this request.

- This debit card should only be used at the pharmacy for prescriptions. All other In-Network claims are processed automatically, ‘behind the scenes.’

- Once your HRA fund of $1,750, has been used up for the year, save the debit card in a safe place. This debit card is issued every 3-years, and it can be used again for the next plan year. If the debit card has expired, Cigna will send you a new debit card.

My FSA & DCA Benefits

An FSA is an annual election whereby an employee can elect to make pre-tax contributions to:

General Medical Reimbursement Account

- A healthcare Flexible Spending Account (FSA) an account that allows you to set aside pre-tax dollars for eligible medical, dental, and vision expenses for you and your dependents, even if they are not covered under your primary health plan.

- At the beginning of the plan year, your account is pre-funded, and your full contribution is immediately available for use. Your election amount is then deducted from your paychecks in equal installments throughout the year. IMPORTANT: Elections cannot be changed during the plan year unless you have a qualified change in family status.

- If you expect to incur medical expenses that won’t be reimbursed by another plan, you’ll want to take advantage of the savings this plan offers. Money contributed to a healthcare FSA is free from federal and state taxes and remains tax-free when it is spent on eligible expenses. On average, participants enjoy a 30% tax savings on their annual contribution.

Plan Details:

- Contribution limit $3,300 (per employee)

- Payroll: Weekly – 52 Weeks

- $660 of unused funds will roll into your next plan year’s account. Any remaining balance over $660 will be forfeited.

- Go to https://fsastore.com/fsa-eligibility-list?AFID=489939&GroupName=TPA&CID=437559&utm_source=Healthy+Dollars%2c+Inc&utm_medium=TPA+Public+Link+EL&utm_campaign=TPA+Partner for a full list of eligible expenses.

- Plan Termination: Date of Termination – Employees have 3 months from the last date of employment to submit claims for payment or reimbursement.

Dependent Care Account

A dependent care FSA is a flexible spending account that allows you to set aside pre-tax dollars for dependent care expenses, such as daycare, that allow you to work or look for work. You choose an annual election amount, up to $5,000. The money is placed in your account via payroll deduction, in equal installments, and then used to pay for eligible dependent care expenses incurred during the plan year.

2025 Dependent Care FSA Plan Details:

- Contribution limit $5,000 (per family)

- Payroll: Weekly – 52 Weeks

- Funds are available as they are withdrawn from your paycheck and expenses incurred. You must have funds in your dependent care FSA before you can spend them.

- Daycare, after-school care, summer camps, adult daycare.

- Continual reimbursement 2 business days after payroll available if you are using a consistent provider, such as a daycare or preschool. Please note, summer & vacation camps may not be reimbursed until the camp dates have happened. Submit a manual claim for a one-time reimbursement or automatic continual reimbursement.

- Plan Termination: Date of Termination – Employees have 3 months from the last day of the month of insurance eligibility to submit claims for payment or reimbursement.

Eligibility

All full-time employees who work at least twenty (20) hours per week are eligible for medical coverage the first of the month following/coinciding with 90 days of continuous employment. Eligible dependents include spouse and dependent children to age 26.

To access the FSA Store please visit: https://fsastore.com

My FSA Store Benefits

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending Account.

Did you know you could use your FSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA dollars can cover? Simply toggle to “FSA” on the drop-down menu and enter the product you are looking for in the eligibility list below.

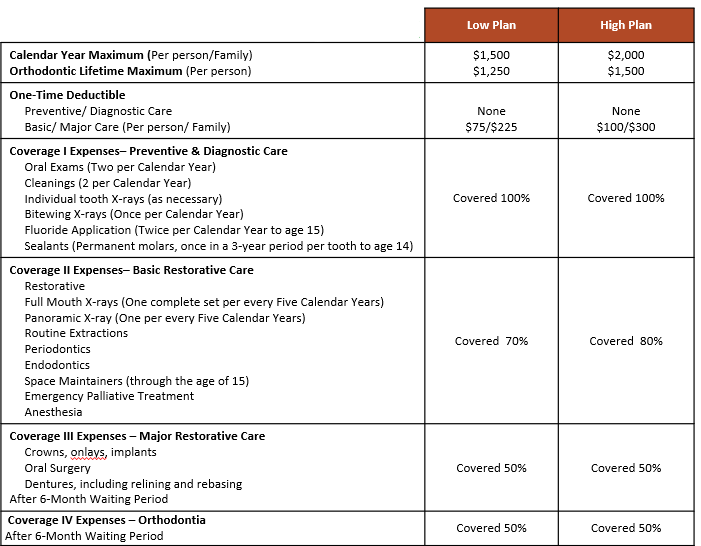

My Dental Benefits

The Richards Group offers two contributory dental plans to its employees: a Low Plan and a High Plan.

Northeast Delta Dental Videos

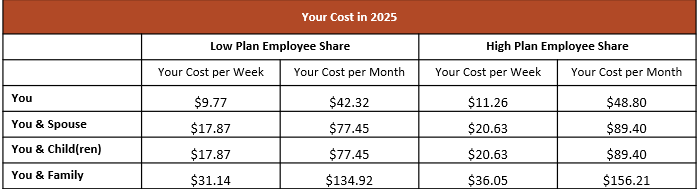

Contributions

Eligibility

All full-time employees who work at least twenty (20) hours per week are eligible for dental coverage the first of the month following/coinciding with 90 days of continuous employment. Eligible dependents include spouse and dependent children to age 26.

Local Dentist Search – Please be aware that you can choose from PPO or PREMIER networks.

Additional Plan Information

Learn how to get the most out of your Delta Dental plan

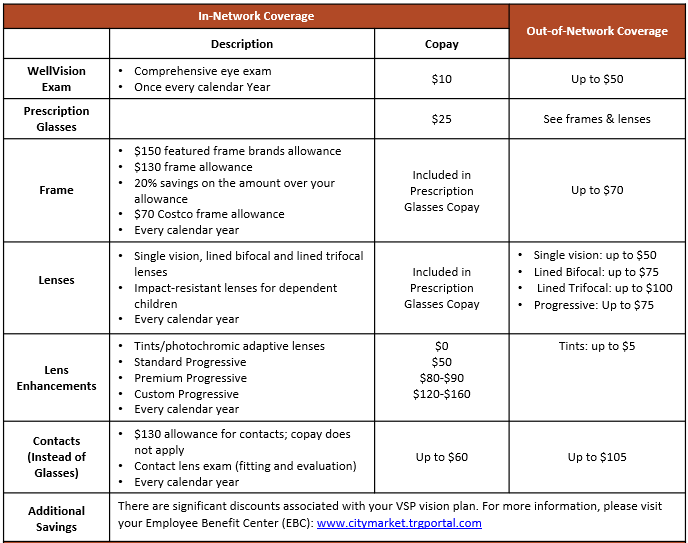

My Vision Benefits

City Market offers vision insurance through VSP.

New for 2025 Buy-Up Plan: If you don’t wear prescription glasses with VSP LightCare, you can use your frame and lens benefit to receive non-prescription eyewear from your VSP network doctor.

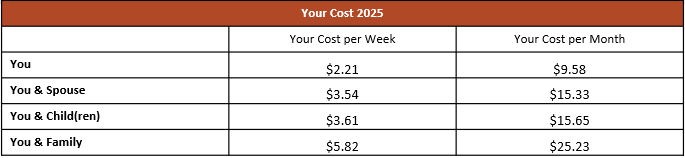

Contributions

Eligibility

All full-time employees who work at least twenty (20) hours per week are eligible for vision coverage the first of the month following/coinciding with 90 days of continuous employment. Eligible dependents include spouse and dependent children to age 26.

My Voluntary Life and AD&D Benefits

City Market offers their employees the option of enrolling in Voluntary Life and Accidental Death & Dismemberment benefits.

Evidence of Insurability

To make the application process easier, employees can apply electronically through our e-App system at mutualofomaha.com/eoi.

Contributions

This is 100% Employee paid.

Eligibility

All full-time employees who work at least twenty (20) hours per week are eligible for coverage the first of the month following/coinciding with 90 days of continuous employment. Eligible dependents include spouse and dependent children to age 26.

Forms and Plan Information

My Voluntary Short Term Disability Benefits

City Market offers Short Term Disability coverage. The benefits pay out if you are disabled, on the 15th day, due to an accident or the 15th day due to an illness. The benefits pay up to 60% of your weekly pre-disability income, up to a limit of $1,000 per week. Benefits can last up to 24 weeks for a continued qualified disability.

Evidence of Insurability

To make the application process easier, employees can apply electronically through our e-App system at mutualofomaha.com/eoi.

Contributions

This is 100% Employer paid.

Eligibility

All full-time employees who work at least twenty (20) hours per week are eligible for coverage the first of the month following/coinciding with 90 days of continuous employment. Eligible dependents include spouse and dependent children to age 26.

My Voluntary Long Term Disability Benefits

City Market wants to help you maintain an income when you need it the most. They offer employees a long term disability plan that will cover 60% of your salary to a maximum of $6,000 per month.

Evidence of Insurability

To make the application process easier, employees can apply electronically through our e-App system at mutualofomaha.com/eoi.

Contributions

This is 100% Employee paid.

Eligibility

All full-time employees who work at least twenty (20) hours per week are eligible for coverage the first of the month following/coinciding with 90 days of continuous employment. Eligible dependents include spouse and dependent children to age 26.

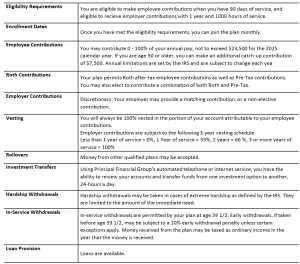

My Retirement Benefits

City Market offers a 401 (k) plan to employees through Principal Financial Group. Principal Financial Group offers a wide selection of investment options and excellent online technology to help you plan better for retirement. Basic plan details are listed below and outlined in more detail in the Summary Plan Description. If you have questions about the plan, you can send an email to HelpRetire@therichardsgrp.com to receive assistance from TRG Retirement Plan Consultants. You can also call Principal Financial Group directly at (800) 547-7754 and should enroll and access your retirement account online at https://www.principal.com/

Contact Information

Have Questions?

TRG Retirement Plan Consultants are available to help

Email: HelpRetire@therichardsgrp.com

My EAP Benefits

City Market provides all employees with an Employee Assistance Program (EAP) through Invest EAP, an independent, industry-leading company that specializes in health care management. EAP is a voluntary, confidential service that provides professional counseling and referral services designed to help with personal, job or family related problems.

EAP consultants are available 24 hours a day, 7 days a week, 365 days a year. Any services provided by the EAP counselors are at no charge to you or your family members.

In addition to phone-based help, a lot of information can be found online, such as self-assessment tools, interactive databases, health and wellness calculators, webinars and podcasts.

Licensed professionals provide confidential support and guidance related to:

- Family, relationship and parenting issues

- Basic child and elder care needs

- Emotional and stress-related issues

- Conflicts at work or home

- Alcohol and drug dependencies

- Personal development and general wellness issues

- Financial issues

- Legal issues

- They can also refer you for in-person counseling

Contributions

This is 100% Employer paid.

Eligibility

All Employees upon date of hire.

Additional Benefits

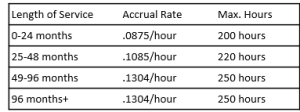

Paid Time Off (PTO)

Employees accrue up to 4 weeks of paid time off (PTO) in their first year, which increases over time. In addition to PTO, City Market also offers Paid Parental Leave and Bereavement Leave. City Market employees can also participate in paid volunteering opportunities throughout the year so that we can all engage in strengthening our community.

City Market Store Discount

(Effective within the first week of employment.)

- 20% off all purchases (except alcohol and stamps) – anytime.

- 25% off Hot/Cold deli bar (including premade sandwiches and deli wraps as available) – only during work shift.

- Plus, free coffee, tea, hot chocolate, and bone broth, and reverse osmosis (RO) water at work.

Transportation and Membership Equity Reimbursement Incentive

Eligible employees can receive reimbursements when they commute to work by bus or bike, for parking fees, or if they choose to make equity payments for City Market membership.

Charitable Giving

After one year of continuous employment employees are eligible for a charitable donation match of up to $200 per fiscal year to any donation made to a tax-exempt non-profit organization.

Store Charge Account

Employees in good standing who have completed their three-month introductory period are eligible to charge up to $150/week (full-time) or $75/week (part-time) at the register. Payments are made through payroll deductions. All charges Monday through Sunday are deducted from the next Friday paycheck.

Holiday Pay

If you are scheduled to work on Thanksgiving and Christmas, you get the day off and get paid for it. Labor Day, Juneteenth, the day before Thanksgiving, Christmas Eve, and New Year’s Day are time and a half pay.

Anniversary Gifts

$10 per year worked automatically gifted to active employees on the final paycheck of your anniversary month. Monthly anniversary and birthday celebration days.

Income Advance Loans

Employees in good standing who have completed 6 continuous months of employment at City Market are eligible for no credit check, low-interest loans of up to $1,000 with Vermont Federal Credit Union. Loan payments are arranged through payroll deductions and as soon as your current loan is paid off you can apply for a new one!

Award Winning Employee Wellness Programming

Our robust staff wellness programming offers incentives for employees who engage in activities to further their physical and mental health.

- Wellness Adventure

- FREE yoga at Sangha Studios – sangastudio.org

- FREE rock climbing at Petra Cliffs – petracliffs.com

- Discounted gym membership at the Edge – sign up anytime, memberships are month-by-month and are paid via payroll deductions.

- Wellness Check-ups & Dental Cleanings

- Flu Shot/Vaccination

City Market Classes

City Market employees may participate in our Community Engagement class programming free of charge. Pre-registration may be required.

City Market Learning Library

Mini resource libraries at each store location include all sorts of great books and even a few yard games. City Market employees may sign out one book at a time for up to three weeks.

Community Partnerships & Discounts

- Park & Museum passes – employees may borrow a pass to Shelburne Farms, Shelburne Museum, ECHO Science Center, Catamount Family Center, or Vermont State Parks for up to four days. Passes are available on a first come, first served basis.

- City of Burlington – Downtown FREE parking permit program for eligible employees

- Downtown business discounts – visit ChurchStMarketplace.com for the latest list of offerings, and when in doubt, just ask! Proof of employment may be requested.

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

Medicare-eligible employees may begin to receive active-outreach via email or to home addresses.

SmartConnect Contact Information

Phone: 1-833-502-2747 TTY 711

For more information or to get started, please click on the following link:

Additional Information

My Tuition Assistance Benefits

The Richard’s Group tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Contact Information

Phone: (844) GRADFIN

For more information or to schedule a one-on-one consultation visit: